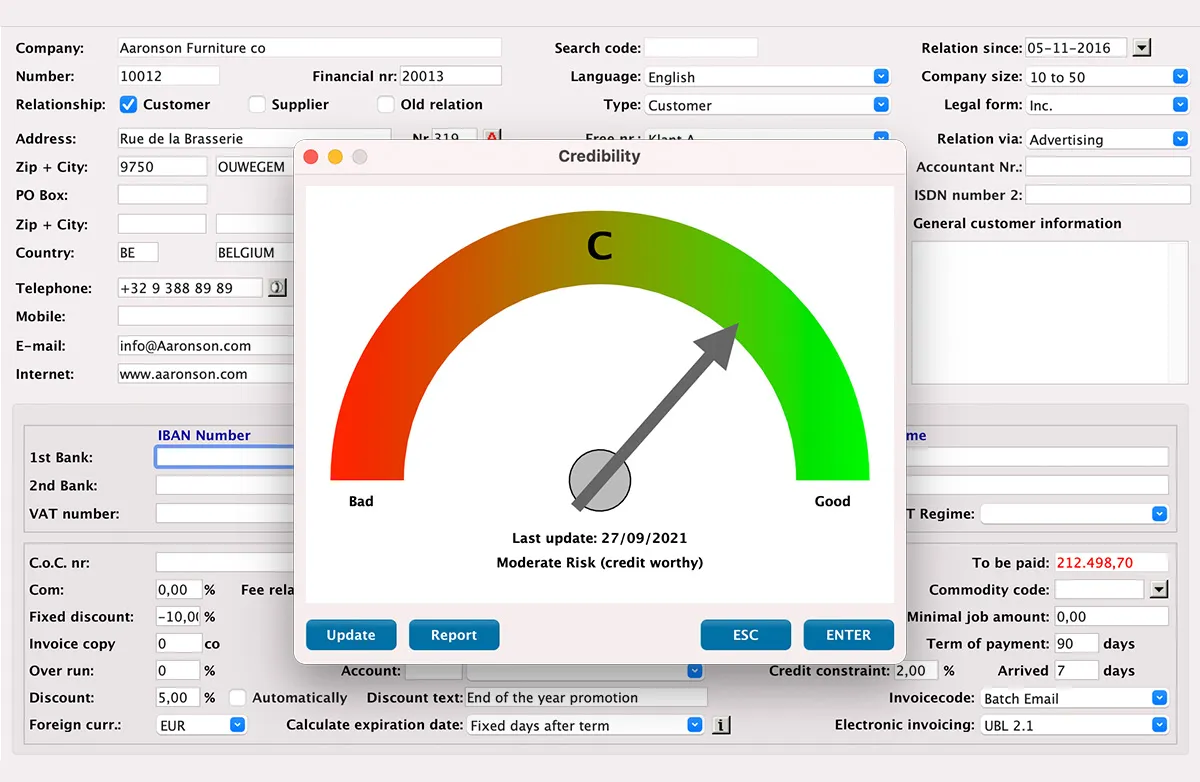

Monitor the creditworthiness of your customers

Avoid being stuck with unpaid invoices because you lose track of your customers' financial situation. MultiPress makes it possible to fully automate the monitoring of your customers' creditworthiness, partly thanks to Creditsafe. This gives you financial security and allows you to work with customers and prospects in complete safety.

Creditsafe collects financial information daily from various sources and statistics and automatically updates the customer data in MultiPress. The data they use to determine scores and limits comes from official sources, such as government and court systems, and from a global network of international data partners. This gives your print media company the most accurate picture of the financial stability of your customers, prospects, and partners.

Checking and manually updating financial information is time-consuming and expensive, but so are unpaid invoices from defaulters. MultiPress makes it possible to fully automate this process. This gives you financial security and allows you to work with clients in complete safety.

- Always up to date: regular checking of the address data of your business relations

- Minimise financial risks: regular checking of the creditworthiness of your customers, prospects and suppliers

- Automatic and efficient: update happens automatically and without manual intervention