E-invoicing, also known as electronic invoicing, is rapidly gaining ground across Europe. The European Union has announced through the VIDA directive (VAT in the Digital Age) that e-invoicing will soon become mandatory for all member states. For those already using MultiPress to manage their administration effectively, adding a separate tool for invoicing is not a smart move. It results in duplicate efforts, a higher risk of errors, and wasted time.

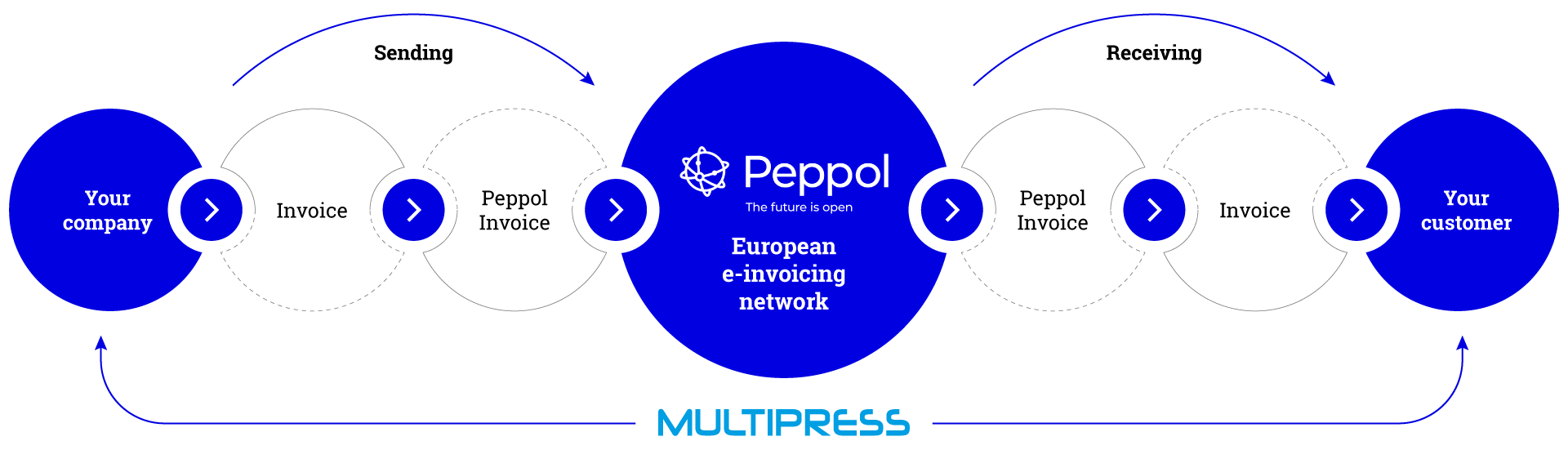

Fortunately, with MultiPress Peppol, you can send and receive electronic invoices in compliance with the Peppol standard. As you know, creating invoices with MultiPress is remarkably fast. All necessary data is gathered and presented instantly. The entire process, from quotation to order to invoice, is fully automated and completed in just seconds.

Yes, I am interested in MultiPress Peppol e-invoicing!

Peppol in Europe: one network, more than 25 file formats

Peppol is the European network for electronic invoicing and document exchange. It functions as a transmission platform used in all European countries. Each country has its own file formats for sending e-invoices through the Peppol network. What differs in the file formats per country? Which fields are mandatory, how detailed the VAT information must be, which national or international rules apply (CIUS or Core Invoice Usage Specification), and so on.

The European standard EN 16931 forms the basis and determines which core data an invoice must contain. (Peppol) BIS 3.0 is an international CIUS of the standard: a specific implementation of EN 16931 with additional rules and restrictions. This sometimes leads to confusion, but the principle remains simple: each country chooses its own content standard, while the transmission always takes place through the European Peppol network, whether you are invoicing in the UK, Italy or Germany.

View the overview of the applied content standards for e-invoicing per European country here:

- Austria: ebInterface (national XML standard) + (Peppol) BIS 3.0

- Belgium: (Peppol) BIS 3.0 (UBL-BE)

- Bulgaria: XML-based standards (ISO 20022)

- Croatia: UBL 2.1 + CII + (Peppol) BIS 3.0 (CIUS HR)

- Cyprus: (Peppol) BIS 3.0

- Czechia: EDIFACT + UBL + ISDOC

- Denmark: OIOUBL (UBL-subset) + (Peppol) BIS 3.0

- Estonia: EVS 923 + UBL

- Finland: TEAPPSXML 3.0 + Finvoice 3.0 + (Peppol) BIS 3.0

- France: UBL 2.1 + CII + Factur-X + EDI/XML + (Peppol) BIS 3.0

- Germany: XRechnung (B2G) + ZUGFeRD 2.0 (B2B) + (Peppol) BIS 3.0

- Greece: (Peppol) BIS 3.0

- Hungary: XML-based standards (compliant with EN 16931)

- Italy: FatturaPA (XML)

- Latvia: XML-based standards

- Lithuania: UBL 2.1 + XML + (Peppol) BIS 3.0

- Luxembourg: UBL 2.1 + (Peppol) BIS 3.0

- Malta: European standards

- The Netherlands: NLCIUS + UBL-OHNL (national) + SI-UBL + (Peppol) BIS 3.0

- Norway: UBL + (Peppol) BIS 3.0

- Poland: UBL 2.1 + CII + (Peppol) BIS 3.0

- Portugal: UBL 2.1 + XML-GS1 + CEFACT

- Romania: SR EN 16931

- Slovakia: No particular standards

- Slovenia: e-SLOG + (Peppol) BIS 3.0

- Spain: Facturae + EN 16931 + (Peppol) BIS 3.0

- Sweden: Svefaktura + SFTI Fulltextfaktura + (Peppol) BIS 3.0

- United Kingdom: EDI/XML + UBL + UN/CEFACT + (Peppol) BIS 3.0

What does this mean for your invoicing process and software?

- Your invoicing software must take into account the file format and content rules applicable in the supplier’s or customer’s country.

- The verification and validation of your invoices is carried out on the basis of both the European standard EN 16931 and the additional specifications (CIUS) per country.

- Do you work internationally? Then choose support for both BIS 3.0 and the national CIUS of the countries where you operate, so that invoices are correctly processed across borders.

That feels like a lot of hassle, doesn’t it? With MultiPress you do not need to worry: the MIS/ERP software will integrate all relevant file formats in time, ensuring your invoicing is always compliant in every European country.

15 reasons why MultiPress Peppol is the only logical choice for e-invoicing!

| MultiPress Peppol | Random other online tool | Peppol for an accounting package |

|---|---|---|---|

Cost efficiency |

Up to 5,000 invoices per month fully included in the monthly price.* *250 if you use the promo. | Unpredictable subscription cost due to usage and hidden fees. | Unpredictable subscription cost due to usage and hidden fees. |

| No need for an API developer to create custom integrations. | A costly developer is required to build an integration between the ERP system and the online tool. | ❌ |

| No need to search for an Access Point yourself. An Access Point is built into the integration. | The Access Point is not always included, leading to additional costs. | ❌ |

| We register you on the Peppol platform. | ❌ | ❌ |

| No costs per user: everyone with access to the invoicing section in MultiPress can send e-invoices.

| Extra costs per user who wants to create e-invoices. | Only users with access to the accounting package can process invoices. |

User-friendliness | Invoices are sent via the Peppol network from MultiPress in just a few seconds. | The full invoice description must be entered manually into the online tool (a legal requirement), which takes an average of 5 to 10 minutes. | It is impossible to send the correct and legally compliant invoice data to Peppol via the accounting package. |

| No additional steps: you can also send a PDF invoice via email in addition to the Peppol format without leaving MultiPress. | ❌ | ❌ |

| Fully integrated with the CRM section of MultiPress to indicate who does and does not want to receive e-invoices. | ❌ | You need to manage separately, in two systems, who does and does not want to receive e-invoices. |

| MultiPress Peppol is standard for sales invoices and optional for purchase invoices. | ❌ | ❌ |

Global connectivity | Send e-invoices to more than 30 countries. | ❌ | ❌ |

| Support for various country-specific formats. |

| Accounting packages offer only minimal country support. |

Multicompany | Seamless integration for multiple entities within MultiPress: ideal for companies with multiple locations. | ❌ | ❌ |

Digital attachments | Ability to include the PDF version of the invoice along with the MultiPress Peppol e-invoice. | Manual import of the PDF invoice required. | ❌ |

Reliability | Fully compliant with Peppol's international standards and protocols, ensuring uniform and secure processing. | ❌ | ❌ |

| Every sent invoice receives a proof of delivery, which is automatically recorded in MultiPress. | ❌ | ❌ |

E-invoicing that works for you

The benefits are crystal clear: with MultiPress Peppol e-invoicing, you transform your print administration into a streamlined, future-proof system. You save both time and money while effortlessly meeting all legal requirements.

Be cautious of providers claiming to send Peppol invoices at a fraction of the cost. These solutions are often unsuitable for print, sign, and SLF businesses. Invoices generated from MultiPress include all the details required by your clients and the law, such as full specifications of printed materials. With MultiPress Peppol, you have a complete e-invoicing solution at the most competitive price, adapted to your number of monthly invoices. Seemingly cheaper alternatives typically send only minimal data, such as a customer number or VAT percentage, which is insufficient in your sector.

Logical choice, isn’t it? Fill in the form above, and we’ll get in touch with you as soon as possible!